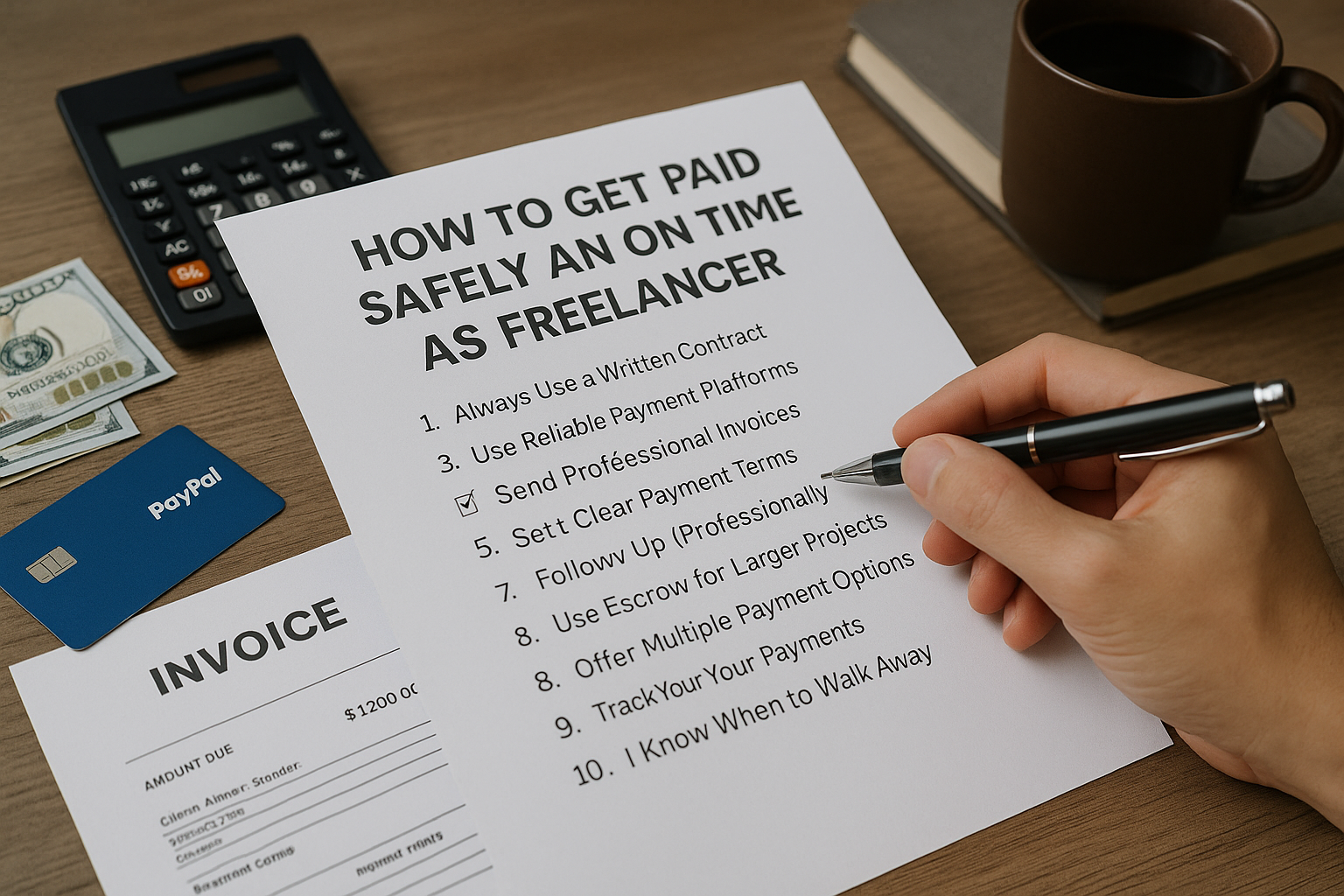

One of the most frustrating challenges freelancers face is not getting paid—or not getting paid on time. Whether it’s late payments, confusing processes, or clients ghosting after the work is done, these issues can disrupt your cash flow and confidence. The good news? You can protect yourself and your income with a few key strategies. In this article, we’ll show you how to get paid safely, professionally, and on time—every time.

Why Payment Issues Happen

Freelancers often deal with payment problems due to:

- Lack of a clear contract

- Vague payment terms

- Working without deposits

- Relying on verbal agreements

- Clients who prioritize other expenses

Prevention is key. With a clear process in place, you’ll minimize the risk of not getting paid.

1. Always Use a Written Contract

A contract protects both you and the client. It defines the scope of work, timeline, pricing, and what happens if things go wrong.

A good contract should include:

- Scope of services

- Delivery deadlines

- Payment terms (amount, method, due date)

- Revisions policy

- Cancellation terms

- Late fees (optional)

Use platforms like Hello Bonsai, And.Co, or create a custom template with Google Docs.

2. Require a Deposit Upfront

Never start work without a partial payment upfront. This confirms the client is serious and gives you leverage.

Common structures:

- 50% upfront, 50% on delivery

- 30% upfront, 40% mid-project, 30% at completion

If a client resists paying a deposit, that’s a red flag. Serious businesses understand this practice.

3. Use Reliable Payment Platforms

Make it easy for clients to pay you using trusted tools. Popular options include:

- PayPal – Fast, global, widely accepted

- Wise (formerly TransferWise) – Great for international transfers

- Stripe – Ideal for credit card payments

- Payoneer – Popular with global freelancers

- Wave – Built-in invoicing and payment system

Choose the method that suits your location, currency, and business type.

4. Send Professional Invoices

An invoice isn’t just a bill—it’s a reflection of your professionalism. Make sure it includes:

- Your name or business name

- Client’s name and contact info

- Invoice number and date

- Description of services

- Amount due and due date

- Payment methods accepted

Use tools like Wave, Zoho Invoice, Bonsai, or even Google Docs to create clean, branded invoices.

5. Set Clear Payment Terms

Avoid surprises by stating your payment terms clearly from the beginning.

Common terms:

- Net 7 / Net 15 / Net 30 – Payment is due within 7, 15, or 30 days of invoice

- Late fees – e.g., 5% fee after 7 days late

- Payment method – Specify exact options you accept

- Currency – Always mention if you’re charging in USD, EUR, etc.

Clarifying these terms protects you legally and sets expectations early.

6. Follow Up (Professionally)

If payment is late, don’t be afraid to follow up. Many clients simply forget or miss the invoice.

Sample follow-up email:

Subject: Friendly reminder – Invoice #101 due

Hi [Client Name], just a quick reminder that Invoice #101 for [Project Name] was due on [Date]. Please let me know if you need the invoice resent.

Thank you!

[Your Name]

Be polite but firm. Follow up every 3–5 business days if needed.

7. Use Escrow for Larger Projects

For high-ticket work, consider using an escrow service. These platforms hold the client’s payment until the work is approved, protecting both sides.

Trusted escrow platforms:

- Upwork (for contracts on the platform)

- Escrow.com

- Fiverr Business

- Freelancer.com escrow system

Escrow ensures you’ll be paid as long as you deliver the work as agreed.

8. Offer Multiple Payment Options

The easier you make it for clients to pay, the faster you’ll get your money.

Provide:

- Bank transfer (with correct account details)

- PayPal or Stripe link

- Credit/debit card option (via Payoneer or Wise)

- Country-specific options (like PIX in Brazil, GCash in the Philippines)

Always double-check that all links and details are correct on your invoice.

9. Track Your Payments

Use a simple spreadsheet or a tool like Bonsai, Wave, or Notion to track:

- Sent invoices

- Paid vs. unpaid

- Due dates

- Follow-up history

Staying organized ensures no payments fall through the cracks.

10. Know When to Walk Away

If a client repeatedly delays or avoids payment—even after reminders—it may be time to stop work or end the relationship.

Protect yourself:

- Pause the project until payment is made

- Add a clause in your contract to stop work after X days of nonpayment

- Report the client on freelance platforms (if applicable)

Your time and effort are valuable. Don’t chase clients who don’t respect that.

Final Thoughts: Get Paid Like a Pro

Freelancers deserve to get paid on time, every time. By setting boundaries, using contracts, and maintaining professionalism, you can avoid the stress of unpaid invoices and keep your business financially healthy.

Remember:

- Always protect yourself upfront

- Make payment simple and professional

- Stay firm, clear, and respectful

Your work has value. And being paid fairly and promptly is part of running a successful freelance career.